Is vacation rental profitable in Spain? An analysis of income and expenses in 2024 and 2025

Vacation rentals in Spain remain profitable in 2025, but only with efficient management: controlling operating costs, optimizing platforms, and using tools like Polaroo can make the difference between making a profit… or just generating revenue.

The vacation rental market in Spain is undergoing a major transformation. As competition grows and the rules of the game change for platforms such as Airbnb or Booking, owners and investors must pay close attention to the key figures for income, costs and real profitability.

In this article, we provide you with a detailed analysis based on recent data from over 2,600 tourist properties managed by Polaroo, as well as specialized sources such as Airbtics, Inside Airbnb, Dataestur, and Statista. Whether you are considering investing in a TUH or already managing one, here you will find everything you need to know to maximize your profitability in 2025.

One of the main attractions of vacation rentals in Spain is the potential for high earnings. According to Dataestur, the average nightly rate for a tourist property in 2024 was €195.87, with a national average occupancy rate of 59.37%.

.png)

Using Airbtics data, which includes the average nightly rate and the average occupancy rate of Airbnb listings in major cities, it is possible to estimate the annual income of a Tourist Use Housing (TUH):

Para tener una imagen completa de la rentabilidad, es crucial entender los gastos asociados a la gestión de tu VUT. Estos incluyen suministros básicos, servicios digitales, limpieza, mantenimiento y logística Operating costs: how much does it cost to manage a TUH?

To have a complete picture of profitability, it is crucial to understand the expenses associated with managing your TUH. These include basic utilities, digital services, cleaning, maintenance, and check-in/check-out logistics.

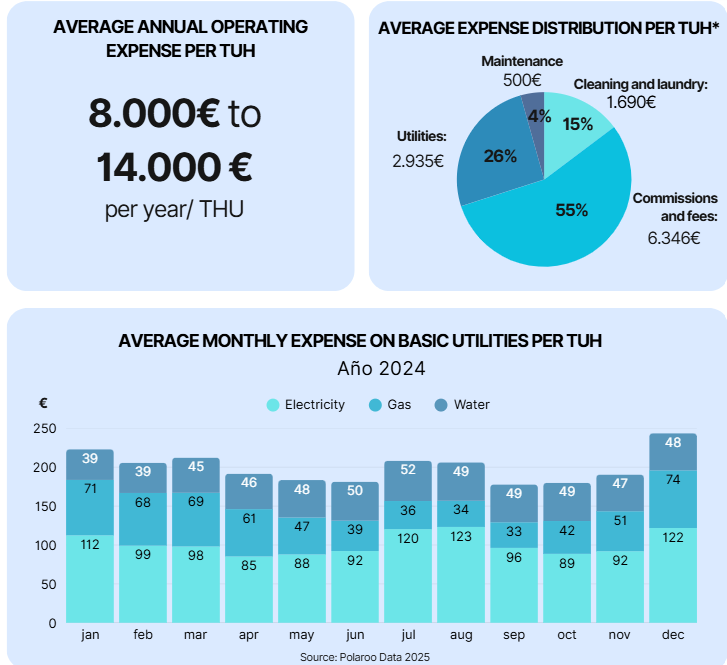

According to Polaroo’s study, annual expenses range between €8,000 and €14,000, depending on location, property category, and turnover rate.

This cost is distributed as shown in the following chart, where it is evident that the most significant expense corresponds to commissions and fees, followed by utilities.

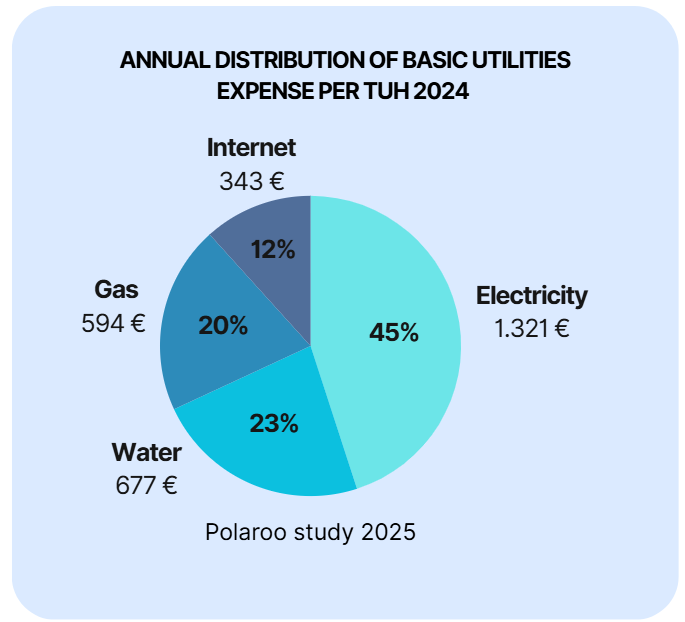

It is also worth noting that within utilities, electricity accounts for an average of 45%, showing the most significant increases during summer months.

* Estimated data based on a national average income of €195.87 per night, an annual occupancy rate of 59.37% (equivalent to 216 occupied days) and an average stay of 5.11 nights for 2024. It uses an average of €40 per cleaning and laundry service, 15% commissions and fees, and utility management includes electricity, water, gas, and internet.

From 44.6% in 2023 to 20–25% in 2024.

Causes: lower MWh prices (-28%), reduced VAT (10%), and liberalization of the telecommunications market.

Utilities, historically one of the main operating expenses, have seen a clear drop in their share of total costs, going from 44.6% of operating expenses in 2023 to around 20–25% in 2024. This decline is due to multiple factors:

One of the most significant trends compared to 2023 is the sharp increase in intermediation costs:

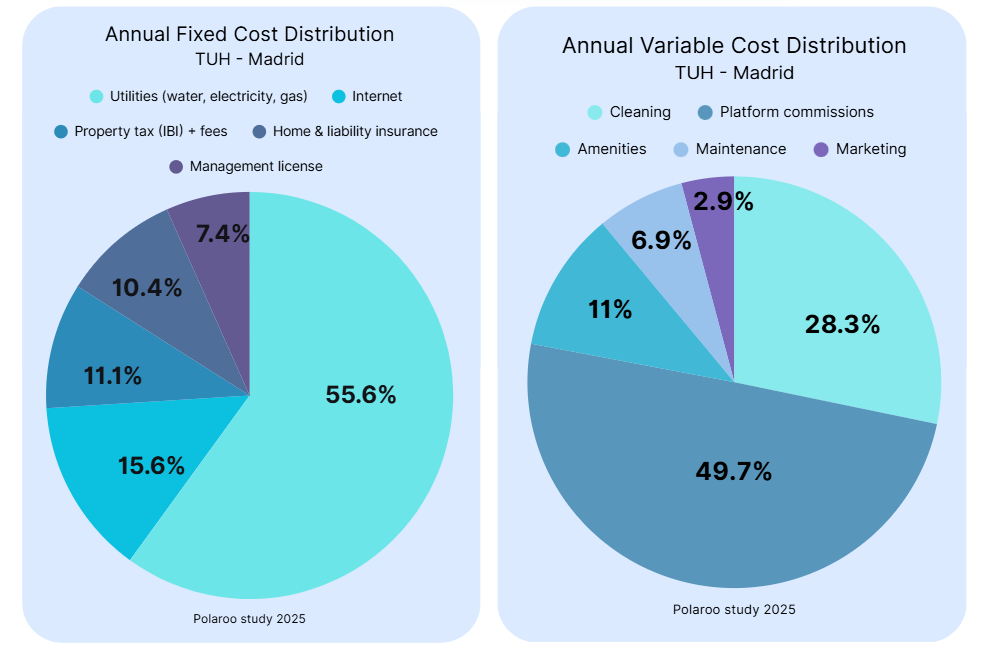

This example analyzes the distribution of fixed and variable costs of a tourist accommodation in Madrid, with an occupancy rate of 75% (274 nights/year), an average stay of 4 nights, and an average income per night of €110.

The goal is to offer a clear and realistic view of annual operating expenses, paying special attention to the impact of utilities, one of the areas where efficiency can make a real difference.

In this scenario:

Fixed costs total €3,000 per year. The largest component is basic utilities (electricity, water, gas) with an estimated annual cost of €1,800, followed by internet at €420/year, and other expenses such as property tax (IBI), fees, insurance, and management licenses totaling €780.

Within utilities, electricity represents the highest expense, especially in winter due to heating use. It is followed by water, gas, and internet.

Variable costs, which depend directly on occupancy, total €7,272 per year. The largest component is platform commissions, which charge 12% on income, generating a cost of approximately €3,617. Next is laundry and cleaning service, with an estimated cost of €2,055/year. Other smaller operating costs include guest supplies (coffee, toiletries, shampoo), maintenance, and marketing, which together account for the remaining €1,600.

In total, the estimated operating profitability of this property is 65%. To have a complete view, it is necessary to include the salary of the manager or any person hired to operate the TUH. This will depend on the number of properties under management, available resources or tools, and process efficiency.

Simulation parameters:

Estimated annual results:

📌 The most relevant cost is platform commission (€3,617), followed by cleaning and utilities.

Investing in vacation rentals in Spain can be highly profitable, but only if managed with strategic vision. Cost control, choosing the right platform, and operational efficiency are determining factors in 2025.

Final tip: consider supply management tools such as Polaroo to automate processes, optimize contracts, and improve the operating profitability of your TUH.

Our service fees pay for themselves with the time and money saved by using Polaroo.